Customer churn is impacting your bottom line, even more so when you’re offering subscriptions. The average churn rate* for SaaS is around 14% (retail is at a whopping 25%). But even an improvement of retention by 5% can increase the customer lifetime value ranging from 35% to 125%. It’s simple: if churn goes down, your revenue goes up.

What does churn mean in business? #

Churn in business terms refers to a measurable loss of customers (or employees, partners, etc.) over a specified period of time. It is usually an important metric to measure the overall health of a company.

Especially in subscription businesses, it’s one of the key metrics to define success alongside customer lifetime value and monthly as well as annual recurring revenue.

What is churn management? #

Churn management describes all activities and tools that help you measure, predict, reduce and prevent churn. It usually includes different activities, tools and processes across a variety of business units (marketing, IT, sales, support, finance, product).

How to calculate your customer churn rate #

Your customer churn rate* measures the proportion of customers that unsubscribe, don’t buy from your business anymore or leave your ecosystem in another way (e.g. cancelling a contract, a club membership, etc.).

Divide lost customers by total customers during a set period and multiply everything by 100 to get the percentage of your churn rate.

Customer churn = (Customers Lost : All customers during a specific time period) x 100

Churn rate calculation example:

You had 263 subscribers during the last month. 27 cancelled their subscription.

(27 : 263) x 100 = 10% churn

*Source: Wikipedia

Why do you need to measure your churn rate?

Your churn rate helps you determine:

- How much revenue has been lost due to lost customers

- How many new customers/subscribers you need

- How much churn can be expected (e.g. when you plan your revenue strategy for the upcoming year)

- Whether there are seasonal or other churn peaks that can be predicted

Additionally, churn rates can support insights into customer lifetime value, expected revenue, and re-activation (e.g., when churned customers re-subscribe or return).

What are important customer churn metrics? #

We recommend a combination of performance data (what happened?) and predictive analytics (what will most likely happen?). This data can give you a great overview of your existing churn and help you plan for the future to either reduce or even prevent churn altogether.

Read more about how predictive analytics works.

Monthly churn rate – tells you about the average monthly churn rate.

Previous churn rate – helps you compare current churn rates with previous months. See, if there are any up- or downward trends detectable.

Expected churn rate – helps you to predict future churn rates (based on your historical data).

Expected customer lifetime – tells you the expected average customer lifetime in days, months or years based on churn rate and other metrics such as their subscription plan.

Churned MRR – tells you how much revenue loss was caused by churned customers

Expected churned MRR – tells you how much revenue loss can be expected if churn develops as predicted (based on your historical data)

We do recommend measuring these metrics individually for different subscription plans or countries. That way, you don’t get averages (which can be misleading) but real insights into churn behavior and trends.

How can you spot customer churn? #

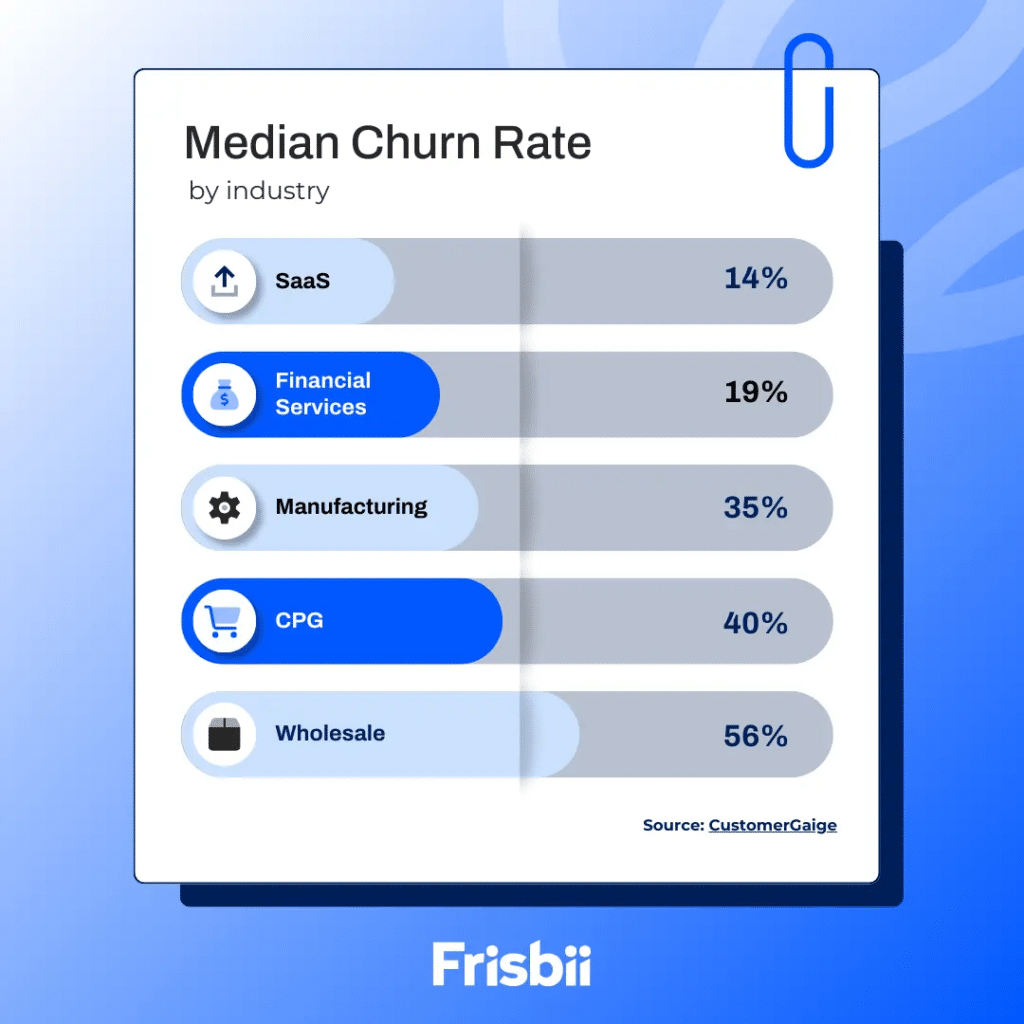

Depending on your industry, the median customer churn rate can range from 11 – 56%*. Trends have shown that churn has increased drastically over the last few years. To prevent churn, you first of all need to know where and when it happens along the customer journey.

Every customer’s journey is different. This is one of the reasons why it’s so difficult to pinpoint channels and customer lifecycle phases. However, if you work with customer health analytics you will be able to identify times and causes a lot easier.

With tools such as Frisbii Revenue Insights, you can predict customer churn behavior based on your own data, enabling you to act before churn even happens.

*Source: CustomerGauge, 2025

Customer churn touchpoints along the (subscription) customer journey #

In the following, we will concentrate on voluntary churn. Voluntary churn describes an active decision to cancel a subscription, leave a company or membership. Involuntary churn is a different cause (often technical) and is discussed in detail in our involuntary churn blog article.

Churn during checkout

A lot rides on your checkout, even if your customers have already decided to subscribe. Any friction, uncertainty, irritation or delay can cause cart abandonment.

The wrong payment method

Choosing the right payment method can be a deciding favor for a subscription. It guarantees quick and easy payments for your customers. Ideally, it also has payment fees that don’t hurt your revenue too much.

Opaque pricing

Especially in SaaS or many B2B subscriptions, prices are often complicated. Discounts or free trials can equally get confusing if it’s unclear when normal pricing resumes and how much it costs.

Lack of trust

Does the payment window look out of place or not in line with your web store? Do your customers have to share a few too many sensitive information? Are workflows wonky and crash resulting in uncertainty? The checkout experience is standardized. Anything that deviates from it, can create confusion and concern.

Read more about checkout optimization.

Churn during or after onboarding

Any onboarding process combines two very important aspects of your company: your product and your service level. This is especially relevant for SaaS or any subscription that includes a “learning curve”.

A bad UI or UX

A confusing interface, complicated or difficult terminology can easily frustrate. Additionally, onboarding can turn into offboarding if easy mistakes are irreversible.

Lack of onboarding communication

Customers will feel aimless if they don’t get advice or guidelines how to use your product or service. The onboarding phase proves to your customers that their subscription provides value.

Lack of self-service (or unhelpful self-service)

Self-service needs to be simple to use, relevant and helpful. If it is not, your customer support will be flooded with small issues and onboarding questions. Worst case, customers will not even reach out to your support team and churn immediately.

Churn at the end of a trial or discount period

Free trials or discounts for the first few months of your subscription are great incentives to drive conversion. However, if churn rates increase at the end of a trial or discount, you might be losing money. Make sure that incentives have a good return of investment.

Customers only had the intention to use the product temporarily

Some customer segments will only ever use the free trial for their purposes and immediately cancel once it’s over. They never had any intention to subscribe long-term.

Customers did not like the product

Some customers will cancel because they didn’t like the product or had a bad onboarding experience. Knowing what competitor they went with and why can be a real game-changer.

Customers’ price sensibility doesn’t fit your pricing

Customers might not want to pay anything or more than the discounted price. In these and the aforementioned cases, your discounts might attract the wrong customers. It’s also possible, that your pricing plans do not offer enough flexibility.

Churn during or after support issues

Companies forget that there’s “Service” in SaaS or that think of support as an afterthought usually have higher churn rates during critical issues. Good customer service is not just a necessity but also a competitive advantage if done well.

According to the PWC Customer Experience Survey, nearly one third of all customers (29%) stopped using or buying from a brand due to a bad customer experience.

No contact options

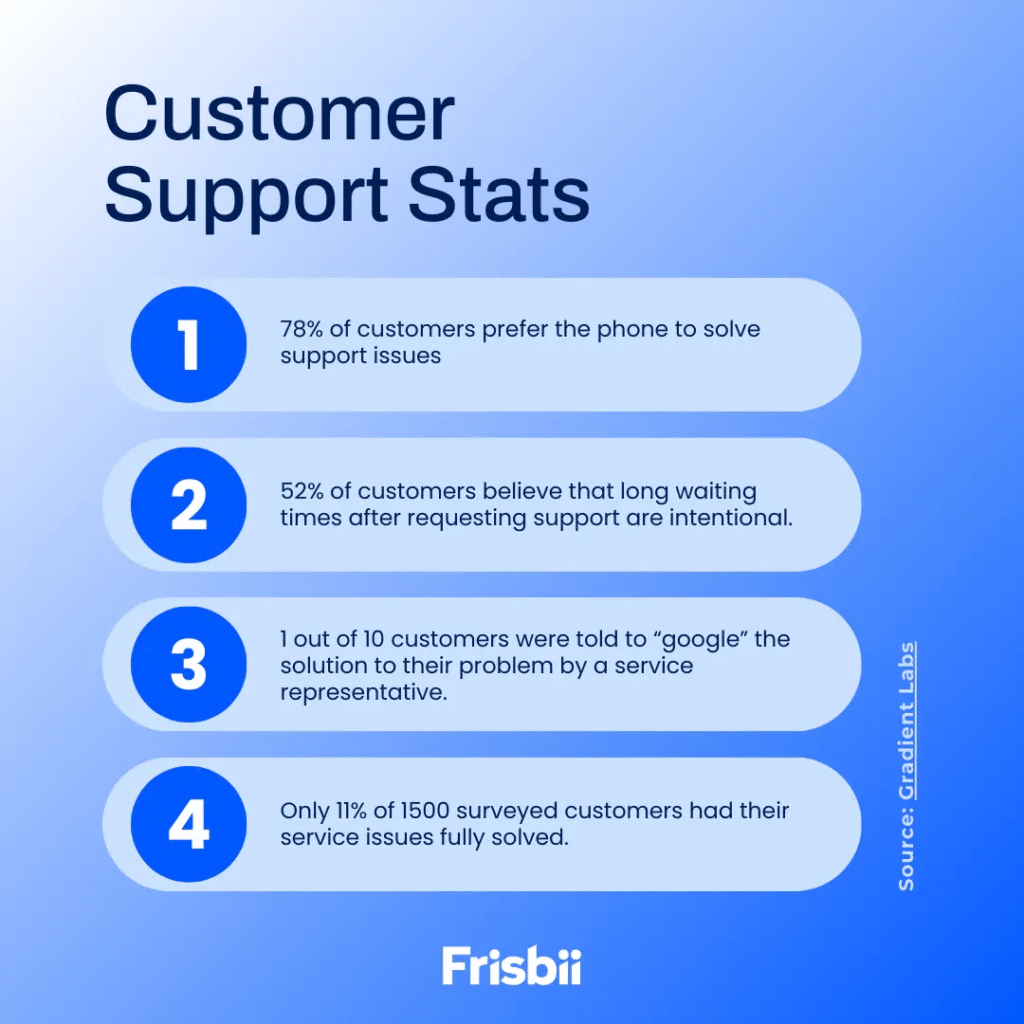

Hidden or non-existent contact options can actively hurt your business. There should always be at least one contact channel (phone, mail or chat) to reach human service. By the way, 78% of customers still prefer to pick up the phone (source: Gradient Labs).

Slow response times

Leaving customers waiting without any timeframe increases frustration. Especially, when the issue at hand involves sensitive topics such as payments or downtime. In fact, 52% of customers believe that long waiting times are intentional (source: Gradient Labs).

Rudeness (the human factor)

1 out of 10 customers were told to “google it” by a customer service representative (source: Gradient Labs). If the support contact makes the experience worse, then even the solution of the issue might not be enough to fix the loss in trust.

Issues can’t be solved

According to the Gradient Labs survey, only 11% out of 1500 customers had their service inquiries fully solved. 13% said that their problems rarely or never got solved. If an issue continues to be an issue, it can snowball into a reason to churn.

Churn after a price increase

No one wants to pay more for a product or service but sometimes a price increase is inevitable. We’re not here to prevent all churn due to price increases but there are ways to make the medicine go down easier.

The price is too high

If the price increase is far beyond what your customers are willing to pay for your product, it can easily end in disaster. Price sensibilities are not always about money alone, but about how much your customers are willing to pay for your product or service.

The price increase was the last drop

If your customers are already unhappy with you or your product, a price increase can be the final trigger. In this case, it’s not the price itself but rather the whole experience that caused the customer churn.

The price increase was badly communicated

A badly communicated price increase can erode trust and loyalty in a flash:

- You overexplained the increase or played the victim

- You tried to sneak it by your customers

- You didn’t give customers any time to prepare for the changes

Read in our article, how a clean, transparent pricing page can drive conversions.

Frisbii Customer Churn Hacks: the big guide for churn prevention #

Download our churn guide. 20 tips how to reduce customer churn, increase retention, customer lifetime value and revenue.

In our guide, we will discuss topics such as:

- Involuntary churn

- Checkout churn prevention

- Pricing tips

- Customer loyalty standards

- How to leverage free trials

- What to do when a customer wants to cancel